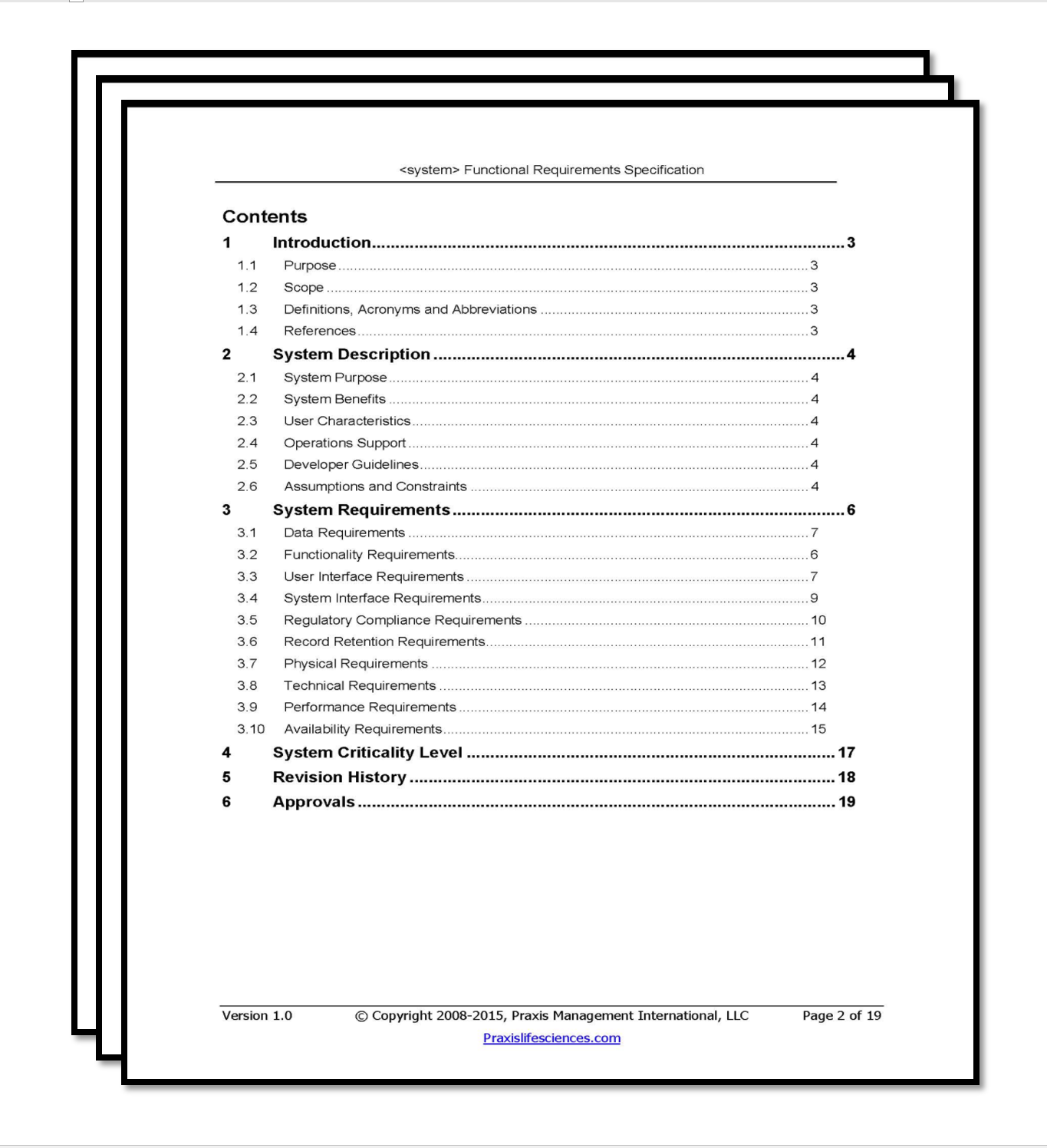

Table Of Content

Your real estate agent can tell you what’s common in your market. Your earnest money deposit goes toward your down payment and closing costs if you buy the home. If you agree to the home sale and later cancel, you’ll typically lose your deposit. When you’re ready to start house hunting or if you’ve found a home you want to buy, it’s time to get preapproved for a mortgage. After you apply, your lender will evaluate your credit, assets and income and give you a preapproval letter stating how much you’re approved for.

Understanding Your Credit Score

The key areas taken into consideration are your income and job history, credit score, debt-to-income ratio (DTI), assets and the type of property you’re looking to purchase. Let’s take a closer look at what each of these factors is and why they’re important to mortgage lenders. If you have a lower credit score or don’t have enough cash saved for a down payment, you might consider an FHA loan.

How To Qualify For A First-Time Home Buyer Loan

Many first-time home buyers don’t know this, but the seller almost always pays their own agent and the buyer’s agent. FHA loans require 3.5% down, and some types of loans allow you to buy a house with no down payment at all. Government-backed USDA and VA loans let you finance 100% of the home price with no money down. During the underwriting process, you'll want to avoid making changes to your finances, such as switching jobs or taking out another line of credit.

Hire a real estate lawyer (if required)

Depending on your circumstances, you might provide other documentation, too. For example, if a family member will give you money for your down payment and closing costs, you must include a gift letter. This provides information about the donor and the amount of their gift. And if you’re using alimony or child support payments for qualifying purposes, you’ll provide copies of the court order.

How To Choose A Mortgage Lender In 7 Steps

There may be other kinds of documentation required, depending on the type of mortgage you’re getting. It's smart to get preapproved by at least three lenders, as comparing rates could potentially save thousands of dollars over the life of the loan. The one that’s best for you will depend on your financial situation and homeownership priorities. One rule of thumb is to have the equivalent of roughly six months’ worth of mortgage payments in a savings account, even after you fork over the down payment.

Closing Costs

There are a couple of big advantages to getting a mortgage preapproval. One, it shows sellers that you can make a solid offer up to a specific price. Two, it helps you figure out what your mortgage will really cost, since you'll get details on the rate, APR, fees and other closing costs. Some of the same sources that offer down payment assistance programs also offer help with closing costs.

USDA Loans: Requirements, Rates & Income Limits 2024 - The Mortgage Reports

USDA Loans: Requirements, Rates & Income Limits 2024.

Posted: Wed, 21 Feb 2024 08:00:00 GMT [source]

The credit score required to buy a house depends on your lender and the type of loan you’re taking out. You can expect to qualify for common types of home loans with a credit score of 620. But some lenders will still consider you eligible with a lower score if you exceed other criteria. You’ll also need to save money to cover closing costs – the fees you pay to get the loan. Several factors determine how much you’ll pay in closing costs, but it’s best to prepare for 3% – 6% of the loan amount. This means if you’re borrowing $200,000 for your purchase, you might pay $6,000 – $12,000 in closing costs.

Tip #3: Don’t Apply For Too Much Credit

Tax returns must show consistent income over the previous 24 months, either remaining roughly the same or increasing. “If you’re interested in bumping up your credit score, your lender may have the ability to help,” recommends Jon Meyer, The Mortgage Reports loan expert and licensed MLO. Typically, pre-approvals are good for 90 days because your situation may change between the time you get pre-approved and when you make an offer. If you’re coming up on the 90 day expiration date, contact your lender to have it refreshed.

Find the best local real estate agent in California

Although similar in name, a preapproval shouldn’t be confused with a prequalification. Prequalifications are less accurate than preapprovals because they don’t require asset verification. While a prequalification can be helpful, it won’t give you the most concrete idea of how much money you’ll be lent, whereas a preapproval can. That’s because lenders require you to provide documents for the preapproval that help prove your income and debt obligations to ensure you’re eligible for the mortgage. 1Participation in the Verified Approval program is based on an underwriter’s comprehensive analysis of your credit, income, employment status, assets and debt. If your eligibility in the program does not change and your mortgage loan does not close due to a Rocket Mortgage error, you will receive the $1,000.

You’ll need to meet the state’s income limits and satisfy a range of other requirements, including completing a homebuyer education course. Refinancing is the process of replacing your current mortgage with a new one. You’ll take out an entirely new mortgage, with a new interest rate and loan term, which is used to pay off your old loan. Some of the most common reasons borrowers refinance their loans are to lower their interest rate or monthly payments.

In her spare time, Miranda enjoys traveling, actively engages in the entrepreneurial community, and savors a perfectly brewed cup of coffee. The minimum down payment will largely depend on the type of loan you choose for your primary or secondary residence or investment property. You likely won’t put any money down if you qualify for a USDA or VA loan. Home sellers often prefer to work with buyers who make at least a 20% down payment. A bigger down payment is a strong signal that your finances are in order, so you may have an easier time getting a mortgage. This can give you an edge over other buyers, especially when the home is in a hot market.

An agent can make or break your deal, so we recommend spending some time to find the right person. Meet with and interview several agents until you find someone you feel confident can help you find your dream home. There are programs that can help you buy a home with as little as 3 percent or no down payment at all. If you qualify for a VA loan, you can usually buy a home with no money down. Since Nov. 30, 1998, the background check system has denied 49,411 attempted firearms purchases by people in the country illegally, a release from Tillis says.

If you end up getting denied for an initial mortgage approval, try not to be discouraged. Talk with your lender about specific ways you can improve your chances of getting a mortgage in the future. With that, let’s look at the items in your financial profile that a lender will typically evaluate, along with the benchmarks you’ll likely need to hit for each one. While a home inspection is not required, it’s highly recommended and helps you avoid any hidden problems that might affect your home value in years to come.

You could pay down your credit card balances to reduce your credit utilization rate. Also, avoid applying for any new forms of credit during the months leading up to a mortgage application. CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them.

Along with paying closing costs, you will review and sign lots of documentation at the closing, including details on how funds are disbursed. The closing or settlement agent will also enter the transaction into the public record. With a preapproval, the lender will review your finances to determine if you’re eligible for funding and an amount they’re willing to lend you. Once you’ve decided on the type of mortgage, it’s time to find a mortgage lender. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

No comments:

Post a Comment